PwC Malta has released the fourth edition of its Property Barometer, which analyses the current local sentiment towards local real estate demand preferences and key trends. The survey was carried out between Q4 2022 and Q1 2023 by means of an online survey, targeting the total population residing on the Maltese Islands, garnering 405 responses. This edition focused on topics relating to purchasing and rental preferences, sources of financing, regulatory developments, sustainability considerations, sentiments towards real estate agents, and available information on the market.

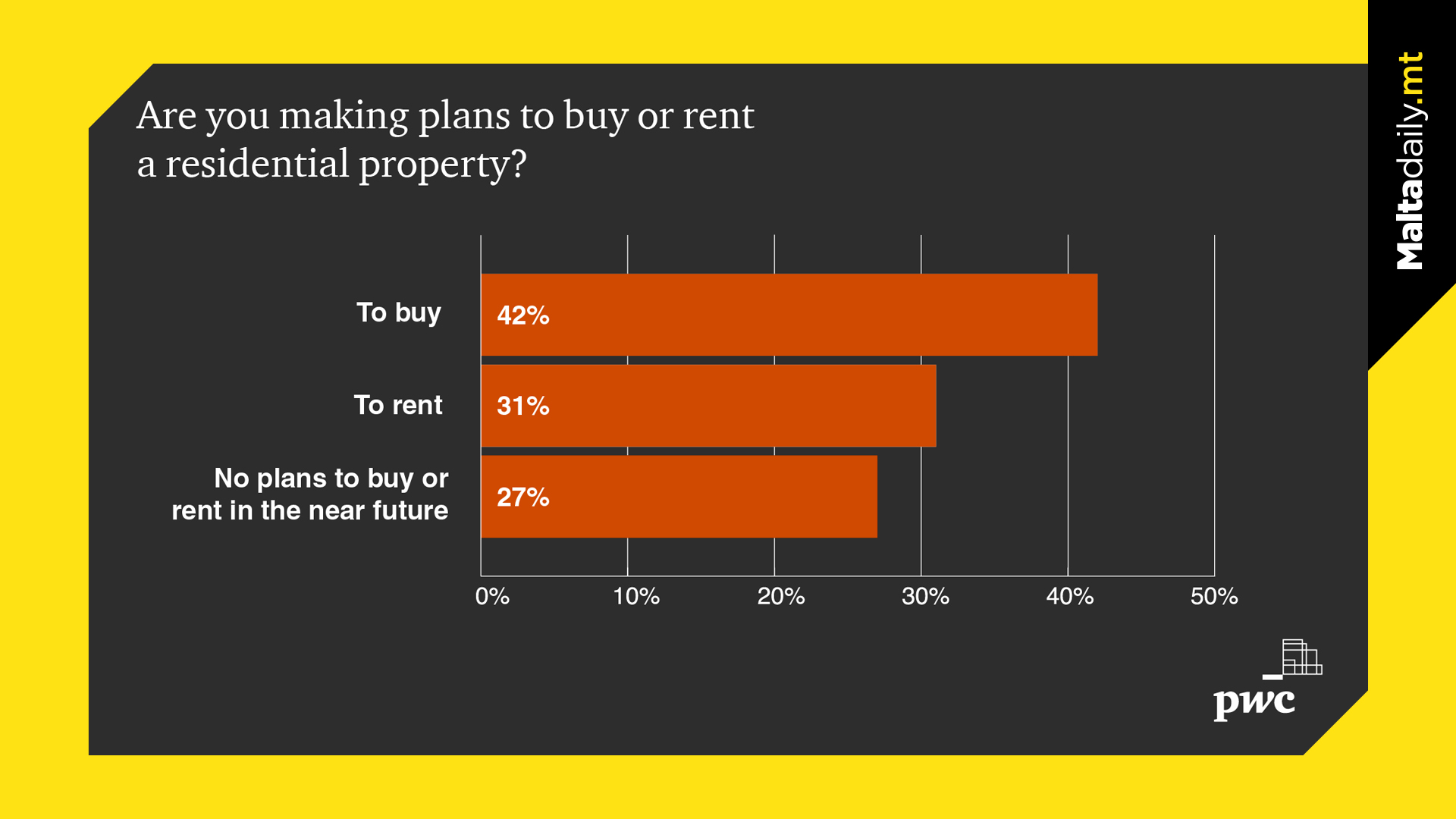

One of the key trends observed during the fourth run is a shift in demand for property sales to rentals. The survey found that demand for property rentals increased to 31% in Q1 2023, up from 12% in Q1 2022, while it fell for property sales, dropping to 42% in Q1 2023, from 51% in Q1 2022. The results of this edition registered the highest demand for property rentals and the lowest for property purchases out of all the barometer editions carried out to date.

These public sentiments seem to echo secondary market data. Data published by the National Statistics Office (NSO) indicated that, during 2022, the number of promise of sale agreements relating to individual buyers of residential property amounted to 11,083, a 22% decrease when compared to those registered in the previous year. Based on data reported in the Housing Authority’s latest Annual Malta Residential Rental Study, by the end of 2021, the rental register comprised almost 38,000 active contracts, representing an increase over the prior year.

A movement between different brackets of property values was also observed in this survey, as respondents shifted towards the lower end of the price spectrum, namely from properties valued above €400,000 to those between €200,000 and €400,000.

The Property Barometer also analysed sources of financing and regulatory developments in the local real estate market, as well as sustainability considerations, sentiments towards real estate agents and available information on the market.

According to the report, the shift in demand for property rentals may be attributed to several factors, including uncertainty surrounding the COVID-19 pandemic, increased flexibility in remote work arrangements, and the desire for more affordable housing options.

PwC Malta cautions that it is yet to assess whether this shift from residential property sales to property rentals is a long-term trend. The report urges stakeholders to continue monitoring the market and adapting to changing consumer preferences.

The Property Barometer provides valuable insights into the current state of the Maltese real estate market, allowing stakeholders to make informed decisions and develop effective strategies for the future.

#MaltaDaily